We here at MOA are always trying to spread the word and inform.

[caption id="" align="alignnone" width="500" caption=""]

[/caption]

[/caption]I've been going back and forth with a few folks in the comments about the importance of issues in this election. Remember those? I'd like to dedicate this post to the issue of taxes.

According to Gallup, half of Americans expect Obama to raise their taxes, while his plan calls for reducing them on 95 percent of households.

At a party last night, I was sort of holding court with my Obama t-shirt and trying to answer all incoming questions.

Q: "What would you say to someone staunchly anti-abortion?"

A: "It depends on what state they live in and if they care about any other issues. If they live in Mississippi, I'm not going to waste my time."

Q: "Give me three reasons why you're for Obama?"

A: "Transparency and accountability in government with more power-sharing and tools for civic engagement than any other president; experience and demonstrated temperament we need right now (community organizing, constitutional law professor, 8-year state legislator with death penalty reform, US senator); a demonstrated ability to listen to and work with opposing views

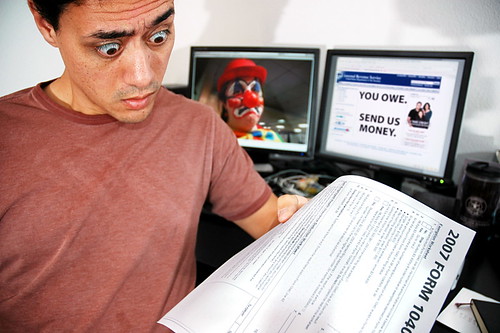

Q: "What do you say to people who worry that Obama will raise their taxes?"

This last question was from a woman whose parents live in Wisconsin (see slightly tightening state polls, advantage Obama). There are certain trigger issues every election that force people to stand on one side of the line or another. Taxation is one of those issues, and Republicans love to lie about how much Democrats are going to tax you. They like to trot out the "tax and spend" liberal label, which makes no sense because that's what government does. It taxes and spends on things like roads, wars, and health care. Personally, I'd be more concerned with a government that taxed but didn't spend (where's my money!?) or spent without taxing (where'd you get all that money from!?).

I promised this woman I'd send her some comparison of Obama vs. McCain on taxes, and I realized that many more people could use this information, so please read and share widely.

First, visit ObamaTaxCut.com. It will calculate your tax savings under Obama and McCain. In fact, I've installed the calculator right here on Jack & Jill Politics in the center column under "Obama Action Center." Here are the key points again.

- Obama will cut taxes for 95% of Americans

- McCain will tax 80% of Americans more than Obama

- Obama will only increase taxes for the very top percent of incomes; and this isn't really an increase: he's simply going to let the Bush tax cuts expire

And here's a 7 minute video version that does a similar comparison. The numbers are a bit different, but the relative point is the same: Obama will let the Bush tax cuts for the wealthiest top percent expire, and he will lower taxes on the middle class and the poor (for whom an extra $800 per year can be critical).

Here's information from the full tax plan (PDF) available at Obama's website:

Cut taxes for 95 percent of workers and their families with a tax cut of $500 for workers or $1,000 for working couples.

Provide generous tax cuts for low- and middle-income seniors, homeowners, the uninsured, and families sending a child to college or looking to save and accumulate wealth.

Eliminate capital gains taxes for small businesses, cut corporate taxes for firms that invest and create jobs in the United States, and provide tax credits to reduce the cost of healthcare and to reward investments in innovation.

Dramatically simplify taxes by consolidating existing tax credits, eliminating the need for millions of senior citizens to file tax forms, and enabling as many as 40 million middle-class Americans to do their own taxes in less than five minutes without an accountant.

Middle class families will see their taxes cut – and no family making less than $250,000 will see their taxes increase. The typical middle class family will receive well over $1,000 in tax relief under the Obama plan, and will pay tax rates that are 20% lower than they faced under President Reagan. According to the Tax Policy Center, the Obama plan provides three times as much tax relief for middle class families as the McCain plan.ii Indeed, according to the National Review, McCain’s plan “offers very little in the way of direct benefits to Americans in the middle of the income scale.”

Families making more than $250,000 will pay either the same or lower tax rates than they paid in the 1990s. Obama will ask the wealthiest 2% of families to give back a portion of the taxes they have received over the past eight years to ensure we are restoring fairness and returning to fiscal responsibility. But no family will pay higher tax rates than they would have paid in the 1990s. In fact, dividend rates would be 39 percent lower than what President Bush proposed in his 2001 tax cut.

Obama’s plan will cut taxes overall, reducing revenues to below the levels that prevailed under Ronald Reagan (less than 18.2 percent of GDP). The Obama tax plan is a net tax cut – his tax relief for middle class families is larger than the revenue raised by his tax changes for families over $250,000. Coupled with his commitment to cut unnecessary spending, Obama will pay for this tax relief while bringing down the budget deficit.

Finally, here's FactCheck.org calling Obama on some of the stretches involved in his claims.

Let's set aside the idea that your selection of a president comes down only to how they promise to affect your taxes (which I think is kind of narrow-minded and wack anyway). On the issue of taxes and self interest, 95 percent of Americans should vote for Obama.

If you have any questions or useful data around McCain and Obama's tax policies, please share.

UPDATE: This bit of information was provided in the comments. I believe it's also an excellent talking point:

There's another issue that I see receiving even less press than in the comparisons of the two tax plans. Forgive me if this has already been covered in your blog, but I rarely hear about the aspect in McCain's tax plan in which he will treat employer provided health care benefits as income. Essentially it's yet another smack at the working families of America.

For the sake of argument, in 2008 say you make $50,000 and your employer pays $10,000 in health benefits for your family (whether directly or through your union). Under the McCain tax plan, In 2009 you will be taxed as if your income is actually $60,000 -- the sum of your actual income PLUS your health benefits. This is regardless of whether or not you even take advantage of your health care benefits that year. And even if you do, it's not as if you will EVER see even a penny of cash in your hand from your health care benefits. Thus, even the graphs and charts McCain provides now for your potential tax cuts are misleading, because he will define your income differently under his plan.

5 comments:

That's because of the superior Republican propaganda machine.

This is what I pointed out in my SWOT message. I knew this would be a problem. Despite having a much better platform and a much better plan on Taxas, the economy, energy, healthcare, and just about everything else... it just doesn't seem to matter because the dems can't get their message out.

You can have the best plan in the world.... but if the people aren't hearing it... if the oppositions propaganda is drowning out the message, then the best plan in the World = nothing.

The dems have always had superior plans... going back to the 80's & 90's... but they haven't had the superior media infrastructure... or propaganda machine. That's one of the fundamental problems for Democrats...and it's been an issue for at least the last 15-20 years at least.

He who controls the message...and controls how Americans perceive information, will often control how people vote. This year is no exception.... especially with an electorate that votes with its heart/emotion rather than based on facts, good information, and sound logic. This is how we ended up with George W. twice...and this is why we are likely to end up with an even worse nightmare with McCain/Palin.

Republicans understand this very well and the Democrats don't seem to have a clue...and the Republicans will keep exploiting this as long as the Dems allow them to.

okay just finished watching a report on cbs highlighting that mccain would provide a tax credit of $2500 for individuals and $5000 for families to offset taxing the health insurance benefits.

1. Is this true?

don't believe them (ha ha)

2. why is the number so low? what happens if you have a catastrophic illness?

I'm doing research too but I just wanted to share.

That's part of his healthcare scheme, entitled "You're On Your Own". It's all smoke and mirrors.

It's part of some program designed to get your employer to take care of your insurance.. in other words, he is advocating for the status quo... nothing close to a comprehensive health plan.

McCain is using healthcare as an excuse to cut taxes for businesses...assuming that business owners would then use the money to take care of the health insurance costs of their employees (NOT GOING TO HAPPEN). In other words... your health would be left to the mercy of insurance companies and your private sector employers... YOU ARE ON YOUR OWN.

And you are correct, McCain does not deal effectively with the issue of catastrophic health costs. Because he has no real plan.

Go back and watch the Republican Convention (I think it was the day when McCain spoke - the final day)... They finally talked about their health plan in a 10 second soundbite. Their health plan = nothing of substance.

McCain would have no interest in fixing healthcare...his constituency = the insurance company execs, etc. Which is why he only wants to offer you a coupon and a bandaid for the current healthcare crisis.

Unfortunately there are thousands of Americans who will fall for this.

Hi AI

Speaking of healthcare I think it would be an interesting litmus test of the commitment of either presidential candidate to a universal healthcare to get them on record as to their stance on a pending bill for an expansion of Medicare, HR 676.

From the web site.

The United States National Health Insurance Act establishes a unique American national universal health insurance program. The bill would create a publicly financed, privately delivered health care system that uses the already existing Medicare program by expanding and improving it to all U.S. residents, and all residents living in U.S. territories. The goal of the legislation is to ensure that all Americans will have access, guaranteed by law, to the highest quality and most cost effective health care services regardless of their employment, income, or health care status. With over 45-75 million uninsured Americans, and another 50 million who are under- insured, the time has come to change our inefficient and costly fragmented non- health care system.

It wouldn't be possible to reduce taxes for 95 percent of Americans, as only a little more than 60 percent of U.S. citizens pay any taxes (including the AMT). (Almost 39 percent of Americans paid NO taxes - thus couldn't have their taxes reduced.)

However, if Obama's plan calls for tax reductions for 95 percent of taxpayers, then the plan could make sense.

The question is really about small business owners. If tax increases target SB, then it will hurt jobs. If it doesn't affect SB, then it would likely be a good thing - boosting consumer spending without affecting most corporations and thus reducing jobs. Rich people and corporations don't need tax breaks right now.

The problem is, both parties are liars. Stop with the hype, and tell the truth. I'd vote for Obama if I had facts (not spin) to validate. (Not that I won't vote for him anyway, but I'm still worried about SB tax killing my job and millions of others. Republican spin maybe?)

Post a Comment